Introduction to No Credit Check Car Loans

No credit check car loans represent a financial solution tailored particularly for individuals grappling with bad credit histories. Unlike traditional car loans that typically scrutinize the borrower’s credit score as a primary qualifying factor, no credit check car loans do not rely on credit history assessments. This characteristic makes them an appealing option for those who may have faced financial difficulties in the past and are seeking to improve their circumstances through vehicle ownership.

The essence of no credit check car loans lies in their accessibility, as they focus on other criteria such as the income level of the borrower, the value of the vehicle, and the ability to make regular payments. The absence of credit checks helps to streamline the borrowing process, allowing individuals with poor credit ratings to bypass the often stringent requirements set by conventional lenders. This approach not only opens up avenues for car ownership but also assists borrowers in rebuilding their credit by making timely payments on the loan.

In recent years, the popularity of no credit check car loans in Canada has surged as more lenders recognize the demand for flexible financing options. Many Canadians are in need of reliable transportation for work, family commitments, or personal mobility, making these loans particularly relevant. By catering to a demographic that has been traditionally marginalized by standard lending practices, these loans represent a pivotal development in the auto financing landscape, emphasizing inclusivity and opportunity.

As such, no credit check car loans provide not just an immediate financial solution but also a gateway for borrowers to regain their financial footing while ensuring they have access to the day-to-day resources necessary for living a functional life. Understanding the mechanisms and implications of these loans is essential for potential borrowers considering this path.

Understanding Bad Credit and Its Impact on Car Financing

Bad credit is commonly defined by a low credit score, typically below 620, which signifies a higher risk for lenders. Factors contributing to a poor credit rating include missed payments, defaults on loans, high credit utilization, and accounts in collections. These elements reflect a borrower’s ability to manage debt and repay loans responsibly. When individuals have a history of financial mismanagement, it can lead to significant challenges, particularly when seeking car financing. Lenders commonly evaluate the creditworthiness of borrowers using credit scores, and those with low scores may face stringent conditions or outright denial of their application.

Individuals experiencing bad credit often encounter barriers in securing a vehicle loan, as traditional lenders frequently categorize them as high-risk borrowers. Such lenders may impose higher interest rates, require larger down payments, or even restrict the loan terms available. This predilection for caution can significantly hinder the ability of those with bad credit to procure reliable transportation, which is essential for attending work, meeting personal obligations, and facilitating daily activities.

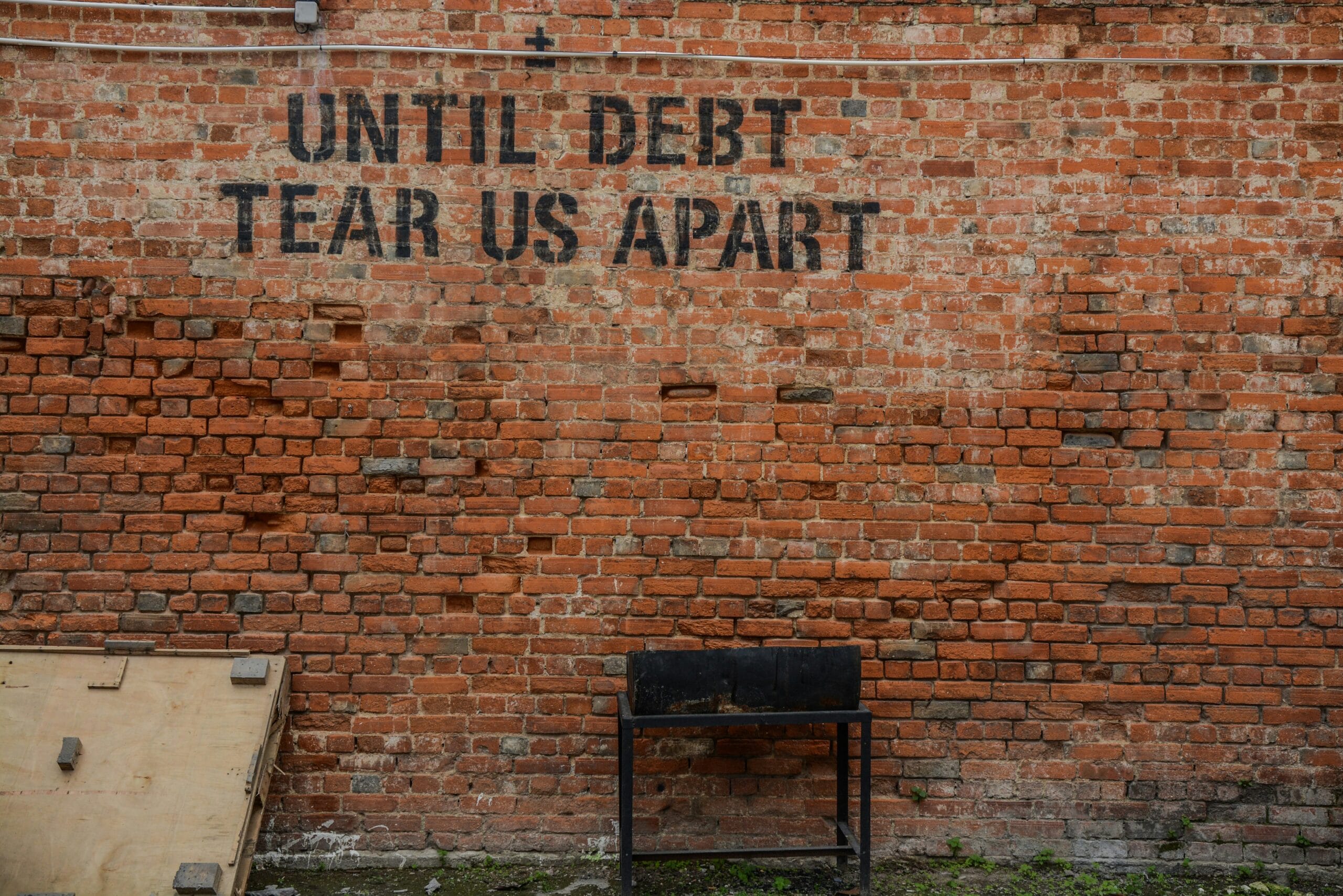

Moreover, lenders use credit scores as a primary metric for risk assessment, leading to an automatic bias against potential borrowers with lower scores. This creates a cycle where individuals needing loans the most, perhaps due to a lack of reliable transportation, find themselves further marginalized. Additionally, the perception of bad credit extends beyond just the numbers; it often carries stigmas that can affect borrowers’ confidence and financial opportunities. Consequently, it is crucial for those with poor credit ratings to understand their current financial standing and explore alternative financing options that cater to their specific circumstances, such as no credit check car loans.

How No Credit Check Car Loans Work

No credit check car loans are specifically designed for individuals who may have challenging credit histories or lower credit scores, thus allowing them to secure financing for vehicle purchases without the traditional barriers associated with credit evaluations. The mechanics of these loans differ significantly from conventional auto financing options.

The application process for no credit check car loans typically begins with the borrower submitting an online or in-person application to a lender. Unlike traditional lenders who heavily rely on credit scores, these lenders focus on alternative criteria to assess a borrower’s ability to repay the loan. Key factors often include the applicant’s income, employment status, and the size of the down payment being offered. This approach opens up opportunities for individuals who may otherwise be denied financing due to their credit history.

It is crucial for borrowers to demonstrate consistent income as this serves as a fundamental indicator of their capacity to meet monthly payment obligations. Lenders may request proof of employment or recent pay stubs to verify income stability. Furthermore, prospective borrowers who can provide a significant down payment may find themselves in a more favorable position, as a larger deposit can reduce the overall loan amount required and demonstrate a level of commitment to the purchase.

Various types of lenders, including credit unions, online lenders, and certain dealerships, provide no credit check car loans. Some of these lenders may impose higher interest rates to offset the risks associated with lending to individuals with poor credit histories. Consequently, it is crucial for borrowers to carefully review the terms and conditions of the loan agreement before proceeding, ensuring they understand their financial obligations over the duration of the loan.

Pros and Cons of No Credit Check Car Loans

No credit check car loans provide a pathway for individuals with poor credit histories to secure auto financing. One of the primary advantages of these loans is the easier access to financing. Traditional lenders often require a thorough credit evaluation, which can disqualify many borrowers. In contrast, no credit check loans can expedite the application process, making it simpler for those in need of immediate transportation. Approval times for these loans are generally quicker, allowing borrowers to obtain the necessary funds for a vehicle promptly.

Despite these benefits, it is crucial to recognize the potential drawbacks associated with no credit check car loans. One significant concern is the likelihood of higher interest rates. Lenders who do not assess credit are often taking on greater risks and may compensate by charging elevated rates, which can lead to expensive long-term debt for borrowers. Additionally, the absence of a credit check may attract unscrupulous lenders who engage in predatory lending practices. These lenders might impose hidden fees, apply pressure tactics, or create terms that are unfavorable to borrowers, leading to financial distress.

Furthermore, while no credit check car loans can address immediate financial needs, they may not contribute to improving the borrower’s credit score. Responsible repayment of traditional loans typically aids in rebuilding creditworthiness, while this option may not have the same effect. Ultimately, it is essential for potential borrowers to weigh the benefits and the drawbacks thoroughly before entering into a no credit check car loan agreement. Evaluating various lending options and understanding the terms is vital to making an informed decision that aligns with one’s financial situation.

Where to Find No Credit Check Car Loans in Canada

Finding no credit check car loans in Canada can be a daunting process, especially for individuals with bad credit. However, several avenues exist where one can successfully secure financing despite their credit history. One prominent option is utilizing online platforms dedicated to offering loans. These websites specialize in connecting borrowers with lenders willing to provide no credit check loans. By using these platforms, borrowers can easily compare rates and terms, which can aid in making an informed decision.

Another avenue to consider is dealership financing. Many car dealerships have in-house financing options that do not require a credit check. These dealerships typically work with a variety of lenders, including those specializing in loans for individuals with poor credit. It is advisable to visit multiple dealerships to explore different financing offers. While dealership financing may seem convenient, it is important for borrowers to thoroughly read the terms and conditions, as some may feature higher interest rates compared to other options.

Credit unions also offer a potential solution for finding no credit check car loans. Unlike traditional banks, credit unions are member-owned and often focus on helping their members improve their financial situations. Many credit unions provide flexible loan options and may be more willing to approve loans for those with less-than-perfect credit histories. To access such loans, it is advisable for potential borrowers to become members of a credit union, which typically requires residing in a specific area or meeting other membership criteria.

When exploring these avenues, it is crucial to identify reputable lenders and avoid potential scams. Researching online reviews, checking with the Better Business Bureau, and ensuring the lender is licensed to operate in Canada are essential steps in the vetting process. By taking these precautions, individuals can enhance their chances of securing no credit check car loans from trustworthy sources.

Preparing to Apply for a No Credit Check Car Loan

Applying for a no credit check car loan can seem daunting, particularly for individuals with bad credit in Canada. However, with proper preparation, one can navigate the process more effectively. The first step is to bolster your financial profile. This includes reviewing your income, expenses, and any existing debts. By demonstrating a stable source of income and a manageable debt-to-income ratio, you enhance your attractiveness to lenders, even in a no credit check scenario.

Next, it is crucial to gather the necessary documentation. Lenders often require proof of income, employment verification, and identification. Having your recent pay stubs, tax returns, and other financial documents organized can expedite the application process. Additionally, be prepared to provide details about your residency status, such as utility bills or lease agreements, as these help establish your creditworthiness in lieu of a credit check.

Understanding loan offers is another vital aspect. Not all loans are created equal; terms, interest rates, and repayment conditions can vary significantly. It is essential to review the annual percentage rates (APR) and any additional fees associated with the loan. Use an online calculator to compare the total cost of different lenders, as this can provide clarity on what to expect in monthly payments.

Moreover, considering a co-signer may improve your chances of securing more favorable terms. If you have a trusted individual with a better credit history, having them co-sign can mitigate the risks for lenders. Ultimately, by improving your financial profile, collecting the right documentation, and comprehensively understanding the loan offers, you position yourself to secure a no credit check car loan that aligns with your financial situation.

Alternatives to No Credit Check Car Loans

Individuals with bad credit often find securing a car loan to be a challenging endeavor. However, there are several alternatives to no credit check car loans that may provide viable options for financing a vehicle. One of the most common alternatives is a secured loan. In this scenario, the borrower offers collateral, typically the vehicle itself or another valuable asset, which reduces the lender’s risk. Because the loan is backed by collateral, lenders may be more willing to overlook poor credit histories, potentially resulting in more favorable terms and lower interest rates.

Another solution for individuals with bad credit is seeking a co-signer. A co-signer with better credit can significantly enhance the chances of loan approval. This individual agrees to take on the responsibility of the loan, providing reassurance to the lender. Having a co-signer not only boosts the likelihood of obtaining financing but can also lead to better interest rates, as lenders typically consider the creditworthiness of both the primary borrower and the co-signer.

Additionally, some dealerships offer special financing programs specifically designed for individuals with poor credit histories. These programs may focus on helping individuals regain financial stability by providing car loans tailored to their needs. Factors such as income, employment history, and down payment can also hold significant weight in determining eligibility for these programs. Therefore, prospective borrowers should research various dealerships to find those that offer financing solutions that cater to their specific circumstances.

An alternative worth considering is credit unions, which often provide loans with more flexible requirements than traditional banks. Credit unions typically focus on their members’ needs and may be more willing to work with individuals who have bad credit. By exploring these options, borrowers can find alternatives to no credit check car loans that may lead them toward successful vehicle financing.

Tips for Managing Your Car Loan Responsibly

Managing a no credit check car loan is critical, especially for individuals with bad credit. One of the foremost strategies is to establish a budget that encompasses your monthly loan payments, insurance, fuel costs, and maintenance expenses. By creating a precise financial plan, you will be able to track your spending, ensuring you allocate enough funds each month to cover the car loan without straining your other financial obligations.

Timely payments are paramount when it comes to maintaining a no credit check car loan. Setting up automatic payment deductions from your bank account is an effective way to avoid missing due dates. Additionally, consider marking your calendar or setting reminders on your phone a few days before payments are due, providing you with extra time to prepare in case of unexpected expenses. Late payments can lead to penalties and further damage to your credit score, making it vital to establish a reliable system for payment management.

Understanding the terms of your no credit check car loan is another essential aspect of responsible management. Carefully read all documentation related to your loan agreement, including the interest rate, repayment schedule, and any potential fees. Familiarizing yourself with these terms will prevent surprises and help you make informed decisions. If you find the terms confusing, don’t hesitate to reach out to your lender for clarification. Knowledge is power, and being informed about your loan allows you to navigate your financing options with confidence and efficiency.

Lastly, communicate openly with your lender. If you’re facing financial difficulties, contact them as soon as possible. Many lenders are willing to discuss alternative payment arrangements or offer temporary relief through deferment options. By taking the initiative to manage your no credit check car loan responsibly, you can bolster your financial stability and work towards improving your credit in the long term.

Conclusion: Making the Right Choice for Your Financial Future

In the quest for vehicle financing, individuals with poor credit histories increasingly explore no credit check car loans as a viable option. Throughout this guide, we have examined the intricacies of such financial products, emphasizing their potential advantages and inherent risks. It is essential to recognize that while these loans can provide immediate access to a vehicle, they often come with higher interest rates and less favorable terms compared to traditional financing options.

One of the pivotal discussions surrounding no credit check car loans has centered on the importance of conducting meticulous research prior to making any commitments. Different lenders have varying policies, fees, and repayment structures, which necessitates a thorough examination of the options available. Additionally, it is imperative to consider the overall cost of borrowing, including how high interest rates and fees could affect long-term financial health.

As prospective borrowers navigate their choices, they must ask critical questions regarding their financial situation and what it entails to take on such debt. Evaluating income stability, other financial obligations, and long-term budgets will aid in making informed decisions. Moreover, potential borrowers are encouraged to seek alternative financing solutions, such as traditional bank loans or financing through the car dealership, which may provide more manageable terms despite a less than perfect credit history.

Ultimately, making the right choice in the realm of no credit check car loans involves careful consideration and a comprehensive understanding of one’s financial landscape. By weighing options and aligning financing decisions with long-term goals, individuals can protect themselves from excessive debt and navigate their path toward a healthier financial future. Whether opting for no credit check lending or alternative routes, the key lies in ensuring every step taken aligns with sustainable financial practices.